- +91 9406205550

-

Understanding Asset Allocation

We often come across the phrase, "Never keep all your eggs in one basket," when discussing portfolio management. While this highlights the importance of diversification, investors interpret it in various ways. Some believe that investing in multiple stocks ensures diversification, while others assume that holding two schemes with similar investment styles achieves the same objective. However, true diversification extends beyond individual securities—it involves asset allocation across different asset classes.

The Importance of Diversification Across Asset Classes

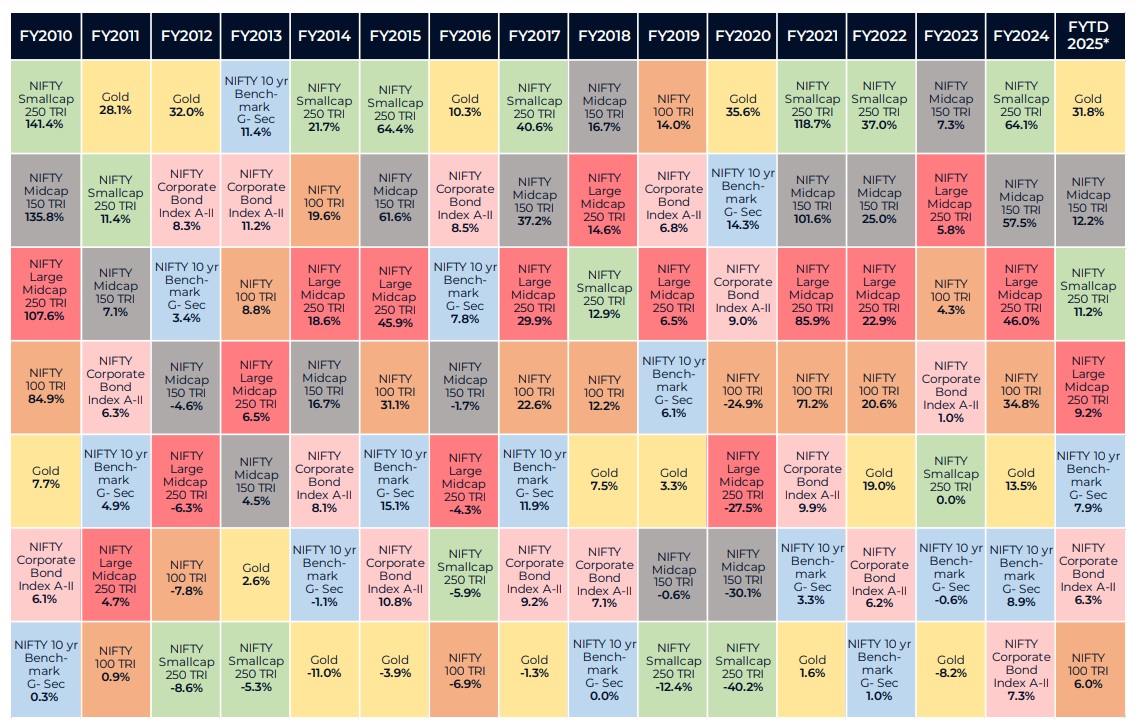

Historical data reveals that different asset classes perform variably over different time periods. Furthermore, within a single asset class, subcategories—such as large-cap, mid-cap, and small-cap equities, or corporate bonds and government securities in fixed-income investments—exhibit diverse performance trends.

For instance, data compiled by HDFC Mutual Fund showcases the year-on-year performance of various asset classes over the past years. From this data, it is evident that equities have generally outperformed other asset classes over the long term. However, it is also clear that equity investments, particularly small-cap stocks, have experienced significant volatility and even negative returns in certain years.

While small-cap investments may generate high returns over the long term, they tend to be highly volatile in the short to medium term. On the other hand, debt investments provide stability with lower returns but exhibit significantly less volatility.

No single asset class consistently delivers the highest returns year after year. Different asset classes thrive under different market conditions. The leader in one year may underperform in the next, making it imperative to diversify across asset classes when building a portfolio. Selecting schemes that do not move in tandem ensures a balanced risk-reward profile, ultimately reducing overall portfolio risk.

The Need for Periodic Portfolio Rebalancing

Asset allocation is not a one-time decision. Investors must periodically review their portfolios to ensure that their original allocation remains intact. Over time, the value of different investments fluctuates, causing a portfolio to drift from its intended allocation. Rebalancing—selling overperforming assets and reallocating to underperforming ones—helps maintain the desired risk-return balance.

Factors Influencing Ideal Asset Allocation

Determining the right mix of asset classes is not a one-size-fits-all formula. The optimal allocation depends on several factors:

Each investor must assess these factors to define their unique asset allocation strategy. As Richard A. Ferri wisely stated:

"The enemy of a good asset allocation is the quest for a perfect one. Fight the urge to be perfect."

Final Thoughts

A well-diversified portfolio helps mitigate risk while optimizing returns over time. By carefully selecting a mix of assets, monitoring allocations, and rebalancing when necessary, investors can navigate market fluctuations more effectively and work towards achieving their financial goals.

Disclaimer

Mutual fund investments are subject to market risks. Please read all scheme-related documents carefully before investing. Past performance is not indicative of future results. The information provided in this article is for educational purposes only and should not be construed as investment advice.

This article was refined with the assistance of ChatGPT, an AI language model, to enhance readability and clarity.

Office Phone :

(+91) 9406205550

Bachat Plus

62/6 Nehru Nagar East,

Agrasen Marg, Bhilai,

C.G. 490020

Risk Factors – Investments in Mutual Funds are subject to Market Risks. Read all scheme related documents carefully before investing. Mutual Fund Schemes do not assure or guarantee any returns. Past performances of any Mutual Fund Scheme may or may not be sustained in future. There is no guarantee that the investment objective of any suggested scheme shall be achieved. All existing and prospective investors are advised to check and evaluate the Exit loads and other cost structure (TER) applicable at the time of making the investment before finalizing on any investment decision for Mutual Funds schemes. We deal in Regular Plans only for Mutual Fund Schemes and earn a Trailing Commission on client investments. Disclosure For Commission earnings is made to clients at the time of investments.

AMFI Registered Mutual Fund Distributor – ARN-99688 | Date of initial registration – 08-Jan-2015 | Current validity of ARN – 05-Jan-2027

Important Links | Disclaimer | Disclosure | Privacy Policy | SID/SAI/KIM | Code of Conduct | SEBI Circulars | AMFI Risk Factors