- +91 9406205550

-

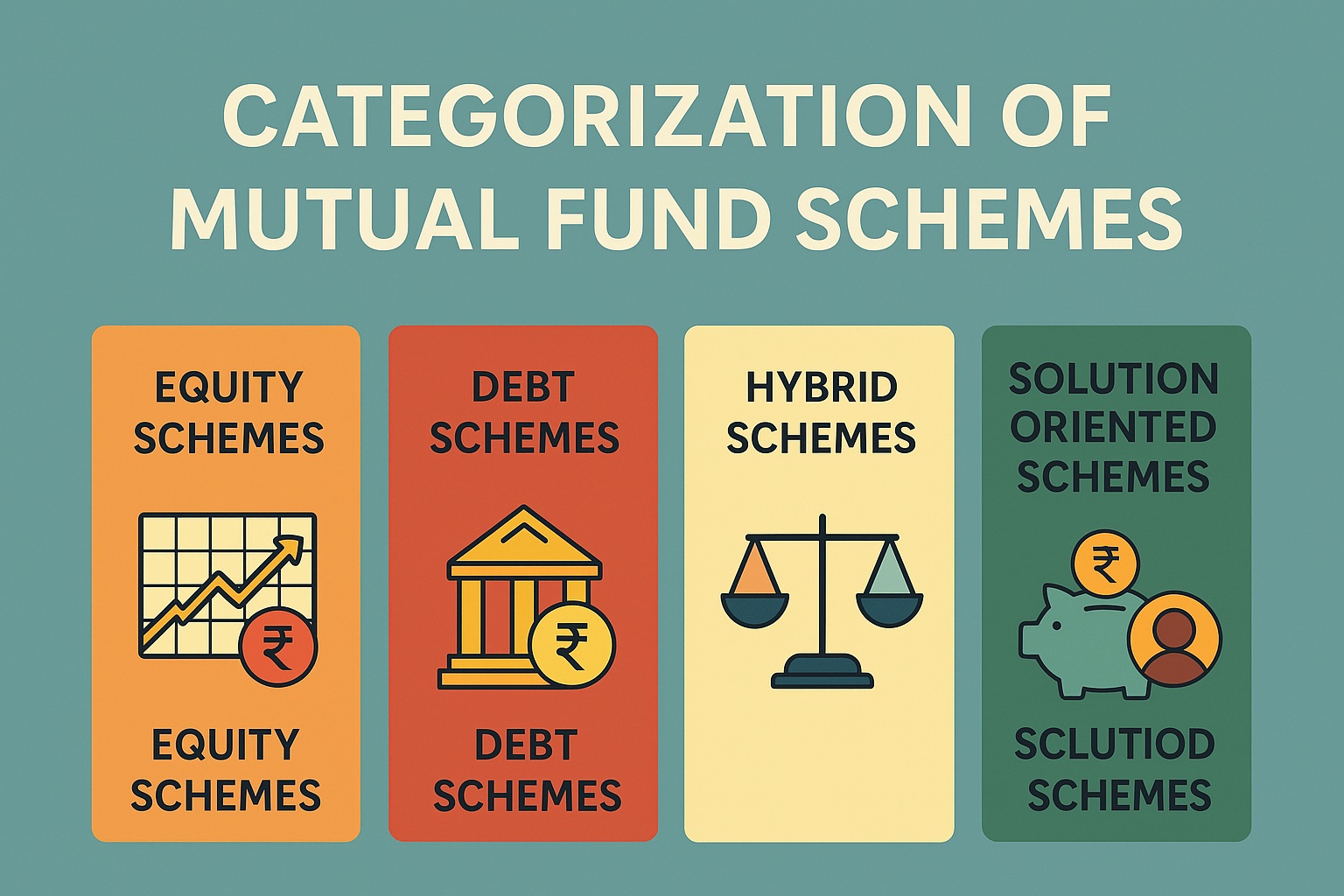

To ensure transparency and consistency in mutual fund offerings, the Securities and Exchange Board of India (SEBI) introduced a comprehensive set of guidelines for the Categorization and Rationalization of Mutual Fund Schemes on October 6, 2017. These rules apply to all open-ended mutual fund schemes in India.

Equity schemes primarily invest in equity and equity-related instruments. They are ideal for long-term investors with a higher risk tolerance.

| Category | Portfolio Characteristics |

|---|---|

| Multi Cap Fund* |

75% in equities with 25% each in Large, Mid, and Small Cap stocks. (Ammended through circular dated 11th September, 2020) |

| Flexi Cap Fund |

Minimum 65% in equities, across all market caps. |

| Large Cap Fund | At least 80% in large-cap stocks |

| Large & Mid Cap Fund | At least 35% each in large and mid-cap stocks |

| Mid Cap Fund | At least 65% in mid-cap stocks |

| Small Cap Fund | At least 65% in small-cap stocks |

| Dividend Yield Fund | Predominantly dividend-paying stocks (min. 65%) |

| Value Fund^ | Value investing strategy with at least 65% in equities |

| Contra Fund^ | Contrarian strategy with at least 65% in equities |

| Focused Fund | Max 30 stocks, at least 65% in equities |

| Sectoral/Thematic Fund | At least 80% in a particular sector/theme |

| ELSS | Minimum 80% in equities, lock-in period of 3 years under ELSS 2005 |

Note: Fund houses may offer either a Value or Contra Fund—not both.

Debt funds invest in government securities, bonds, and other fixed-income instruments. They are suitable for income generation and capital preservation.

| Category | Portfolio Characteristics |

|---|---|

| Overnight Fund | 1-day maturity instruments |

| Liquid Fund | Maturity up to 91 days |

| Ultra Short Duration Fund | Macaulay duration: 3–6 months |

| Low Duration Fund | Macaulay duration: 6–12 months |

| Money Market Fund | Maturity up to 1 year |

| Short Duration Fund | Macaulay duration: 1–3 years |

| Medium Duration Fund | Macaulay duration: 3–4 years |

| Medium to Long Duration Fund | Macaulay duration: 4–7 years |

| Long Duration Fund | Macaulay duration: over 7 years |

| Dynamic Bond | Invests across durations |

| Corporate Bond Fund | Minimum 80% in AA+ and above-rated corporate bonds |

| Credit Risk Fund | Minimum 65% in AA and below-rated bonds |

| Banking & PSU Fund | Minimum 80% in debt from banks/PSUs/PFIs |

| Gilt Fund | Minimum 80% in government securities |

| Gilt Fund with 10-Year Duration | Macaulay duration of 10 years |

| Floater Fund | Minimum 65% in floating rate instruments |

Hybrid funds offer a balanced mix of equity and debt, providing diversification and moderate risk.

| Category | Equity | Debt | Notes |

|---|---|---|---|

| Conservative Hybrid Fund | 10–25% | 75–90% | Lower equity exposure |

| Balanced Hybrid Fund@ | 40–60% | 40–60% | Equal balance |

| Aggressive Hybrid Fund@ | 65–80% | 20–35% | Higher equity exposure |

| Dynamic Asset Allocation / BAF | 0–100% | 0–100% | Allocation managed dynamically |

| Multi Asset Allocation | Minimum 10% in 3 different asset classes | ||

| Arbitrage Fund | Minimum 65% in equity; hedged using derivatives | ||

| Equity Savings | 65% in equities, 10% in debt, rest in derivatives | ||

Note: Only one scheme allowed between Balanced and Aggressive Hybrid Fund.

| Category | Key Features |

|---|---|

| Retirement Fund | Lock-in of 5 years or until retirement (whichever earlier) |

| Children’s Fund | Lock-in of 5 years or until child reaches majority |

| Index Funds / ETFs | Minimum 95% in a specified index |

| Fund of Funds | Minimum 95% in underlying domestic or overseas schemes |

SEBI Circulars on Scheme Categorization (2017)

AMFI (Association of Mutual Funds in India) website

Mutual fund investments are subject to market risks. Read all scheme-related documents carefully before investing. This article is for informational purposes only and should not be construed as investment advice.

Partially generated using AI tools and refined for accuracy by the author.

Office Phone :

(+91) 9406205550

Bachat Plus

62/6 Nehru Nagar East,

Agrasen Marg, Bhilai,

C.G. 490020

Risk Factors – Investments in Mutual Funds are subject to Market Risks. Read all scheme related documents carefully before investing. Mutual Fund Schemes do not assure or guarantee any returns. Past performances of any Mutual Fund Scheme may or may not be sustained in future. There is no guarantee that the investment objective of any suggested scheme shall be achieved. All existing and prospective investors are advised to check and evaluate the Exit loads and other cost structure (TER) applicable at the time of making the investment before finalizing on any investment decision for Mutual Funds schemes. We deal in Regular Plans only for Mutual Fund Schemes and earn a Trailing Commission on client investments. Disclosure For Commission earnings is made to clients at the time of investments.

AMFI Registered Mutual Fund Distributor – ARN-99688 | Date of initial registration – 08-Jan-2015 | Current validity of ARN – 05-Jan-2027

Important Links | Disclaimer | Disclosure | Privacy Policy | SID/SAI/KIM | Code of Conduct | SEBI Circulars | AMFI Risk Factors