- +91 9406205550

-

We often find investors getting drawn towards sectoral and thematic mutual funds—especially when a particular sector fund has outperformed the broader market by a significant margin in the recent past. However, many retail investors tend to rely heavily on recent performance data alone when making investment decisions, often without the tools or resources to conduct a deeper analysis.

But is it prudent to allocate a large portion of your investments to a single sector simply because of its recent stellar performance? Not necessarily. Let’s dig deeper, supported by historical data.

Historical Sectoral Performance: What the Data Says

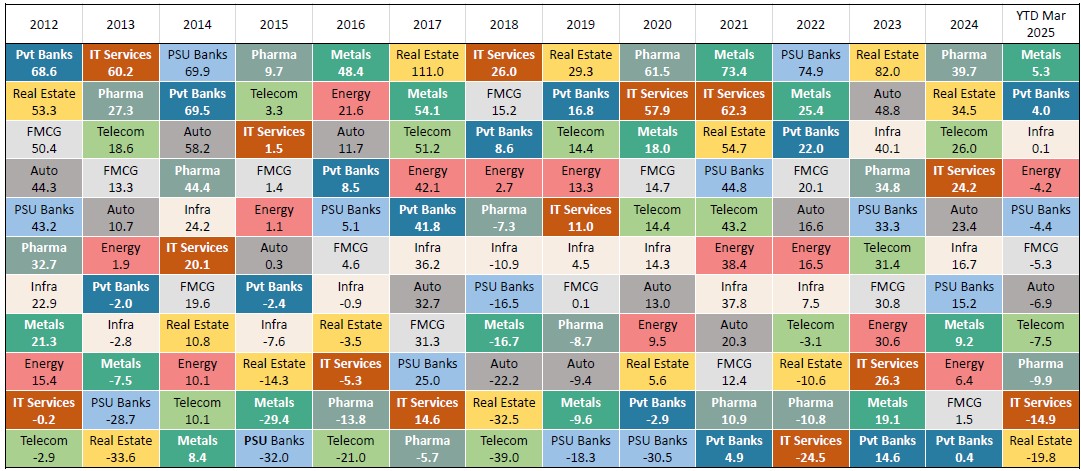

WhiteOak Capital Mutual Fund, in their April 2025 Market Perspective, compiled the year-on-year performance of various sectoral indices dating back to 2012. A quick look at the data yields two key insights:

This makes it clear: Investing solely based on recent performance can be misleading. A sector that has delivered strong returns may underperform in the following years, and chasing past winners may lead to disappointment.

So, How Should Investors Approach Sectoral Funds?

Should you completely avoid sectoral funds? Or should you try to pick the worst performers in the hope of a turnaround? Neither approach is ideal.

Instead, investors can adopt a Core and Satellite Strategy, which offers a balanced approach to portfolio construction.

What Is the Core and Satellite Strategy?

The Core and Satellite Strategy involves dividing your portfolio into two parts:

1. Core Portfolio

2. Satellite Portfolio

Guidelines for Investing in Sectoral Funds

If you choose to include sectoral funds in your satellite portfolio, keep the following in mind:

Conclusion

Sectoral funds can be rewarding—but only when approached with caution and strategy. By combining them within a well-thought-out core and satellite framework, investors can benefit from sectoral opportunities without compromising the stability of their overall portfolio.

Disclaimer

Mutual fund investments are subject to market risks. Please read all scheme-related documents carefully before investing. The views expressed in this article are for informational purposes only and do not constitute financial advice. Always consult a qualified financial advisor before making investment decisions.

This article was refined with the assistance of ChatGPT, an AI language model developed by OpenAI.

Office Phone :

(+91) 9406205550

Bachat Plus

62/6 Nehru Nagar East,

Agrasen Marg, Bhilai,

C.G. 490020

Risk Factors – Investments in Mutual Funds are subject to Market Risks. Read all scheme related documents carefully before investing. Mutual Fund Schemes do not assure or guarantee any returns. Past performances of any Mutual Fund Scheme may or may not be sustained in future. There is no guarantee that the investment objective of any suggested scheme shall be achieved. All existing and prospective investors are advised to check and evaluate the Exit loads and other cost structure (TER) applicable at the time of making the investment before finalizing on any investment decision for Mutual Funds schemes. We deal in Regular Plans only for Mutual Fund Schemes and earn a Trailing Commission on client investments. Disclosure For Commission earnings is made to clients at the time of investments.

AMFI Registered Mutual Fund Distributor – ARN-99688 | Date of initial registration – 08-Jan-2015 | Current validity of ARN – 05-Jan-2027

Important Links | Disclaimer | Disclosure | Privacy Policy | SID/SAI/KIM | Code of Conduct | SEBI Circulars | AMFI Risk Factors