- +91 9406205550

-

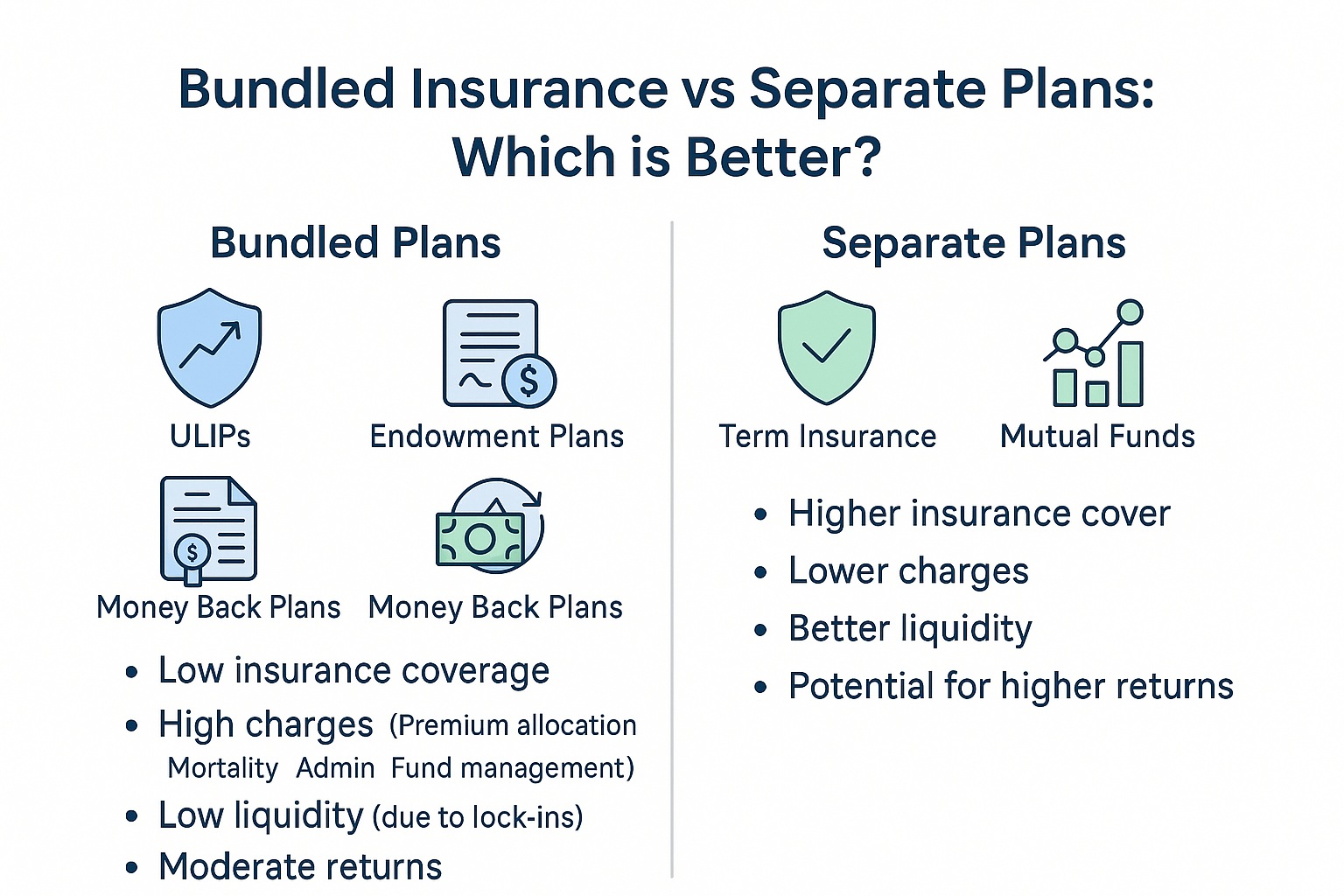

We’ve all come across insurance plans that claim to offer the best of both worlds — insurance coverage and investment returns. Products like Endowment Plans, ULIPs (Unit Linked Insurance Plans), and Money Back Policies are widely marketed as comprehensive financial solutions. At first glance, these bundled plans seem appealing because:

However, a deeper look into how these plans work paints a different picture.

What Actually Happens in Bundled Plans:

Why Avoid Bundled Plans?

You might wonder — why not get a two-in-one solution for investment and insurance? Here's why keeping them separate is often more beneficial:

1. High Charges, Low Returns

Bundled plans, especially ULIPs, come with a range of charges:

These charges can significantly eat into your returns.

2. Low Liquidity

What Should You Do Instead?

Keep your insurance and investments separate.

While it may seem like you're "losing" the premium paid for term insurance, remember:

Final Thoughts

There is no one-size-fits-all solution. Age, health, financial goals, and life stage all play a role in what works best for you. While bundled plans might look convenient, they often don’t serve either insurance or investment objectives effectively.

Always compare your options, understand the fine print, and make informed financial decisions. Consulting a financial advisor can help you assess what combination suits your individual needs.

If you found this useful, share it with someone who’s still paying into a bundled plan. Let’s help people make better money decisions.

Disclaimer:

Mutual fund investments are subject to market risks. Read all scheme-related documents carefully before investing. This content has been assisted by AI (ChatGPT) and is for informational purposes only. It does not constitute investment, insurance, or tax advice. Please consult a qualified professional before making any financial decisions.

Office Phone :

(+91) 9406205550

Bachat Plus

62/6 Nehru Nagar East,

Agrasen Marg, Bhilai,

C.G. 490020

Risk Factors – Investments in Mutual Funds are subject to Market Risks. Read all scheme related documents carefully before investing. Mutual Fund Schemes do not assure or guarantee any returns. Past performances of any Mutual Fund Scheme may or may not be sustained in future. There is no guarantee that the investment objective of any suggested scheme shall be achieved. All existing and prospective investors are advised to check and evaluate the Exit loads and other cost structure (TER) applicable at the time of making the investment before finalizing on any investment decision for Mutual Funds schemes. We deal in Regular Plans only for Mutual Fund Schemes and earn a Trailing Commission on client investments. Disclosure For Commission earnings is made to clients at the time of investments.

AMFI Registered Mutual Fund Distributor – ARN-99688 | Date of initial registration – 08-Jan-2015 | Current validity of ARN – 05-Jan-2027

Important Links | Disclaimer | Disclosure | Privacy Policy | SID/SAI/KIM | Code of Conduct | SEBI Circulars | AMFI Risk Factors