- +91 9406205550

-

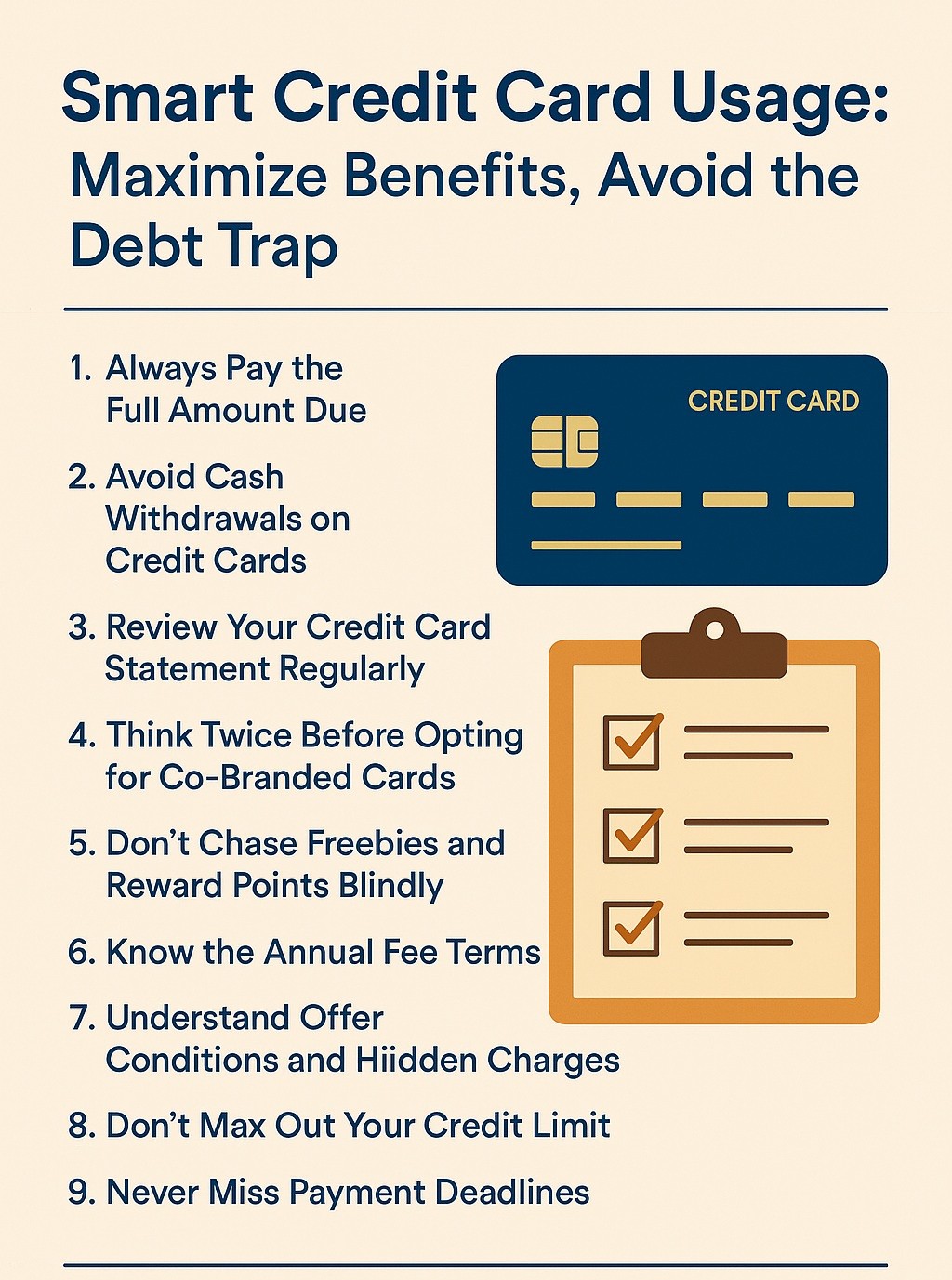

In today’s digital age, getting a credit card is as easy as a few clicks—banks and brands are eager to offer them, often bundled with attractive rewards. While credit cards can be extremely beneficial when used wisely, misuse or ignorance can lead to unnecessary debt and financial stress.

Let’s explore how you can use credit cards to your advantage while staying financially safe:

1. Always Pay the Full Amount Due

Every credit card bill reflects two figures: the minimum amount due and the total amount due. Paying only the minimum might prevent you from being marked a defaulter, but the bank continues to charge interest (often 2–4% per month) on the remaining amount. That compounds quickly and can turn into a debt spiral. Always aim to pay the full amount before the due date.

2. Avoid Cash Withdrawals on Credit Cards

Although credit cards allow cash withdrawals, avoid them unless it’s an emergency. Cash advances attract a hefty fee, and interest begins accruing immediately from the day of withdrawal, unlike regular purchases which may have an interest-free grace period.

3. Review Your Credit Card Statement Regularly

Always scrutinize your monthly credit card bill. Look out for:

Report any discrepancies to your bank promptly to avoid long-term financial impact.

4. Think Twice Before Opting for Co-Branded Cards

Co-branded cards (e.g., a retail chain or airline card) may seem attractive with their partner-specific perks. However, benefits on non-partner spending are often minimal. Choose such cards only if your regular spending aligns heavily with the co-brand partner.

5. Don’t Chase Freebies and Reward Points Blindly

Banks entice customers with reward points or gifts on reaching spending thresholds. However, don’t overspend just to claim rewards. If your usual expenses are far below the set limit, stretching your budget could lead to unwanted purchases or future repayment issues.

6. Know the Annual Fee Terms

Many cards are marketed as “first-year free” or “lifetime free”, but conditions apply. Some cards waive annual fees only if you spend a certain amount in a year. Always read the fine print before signing up.

7. Understand Offer Conditions and Hidden Charges

Popular benefits like fuel surcharge waivers, no-cost EMIs, and airport lounge access often come with caveats:

Read the detailed terms and conditions before assuming the benefit is free.

8. Don’t Max Out Your Credit Limit

Spending up to your credit limit frequently can signal to credit bureaus that you’re credit-hungry. This may negatively affect your credit score. Ideally, keep your usage below 30-40% of your credit limit to maintain a healthy score.

9. Never Miss Payment Deadlines

Timely repayment is crucial. A missed payment can:

Set auto-reminders or enable auto-debit to avoid missed deadlines.

Conclusion:

Credit cards offer fantastic value—brand-specific deals, lounge access, cashback, and reward points—but only if used wisely. A casual approach or ignoring the fine print can result in fees, charges, and debt that outweigh any benefits. Stay informed, spend smart, and enjoy the convenience responsibly.

Disclaimer:

This article is for informational purposes only and should not be construed as financial advice. Readers are advised to consult with a financial advisor before making decisions related to credit card usage. Portions of this article have been enhanced using AI assistance from ChatGPT by OpenAI to ensure clarity and depth.

Office Phone :

(+91) 9406205550

Bachat Plus

62/6 Nehru Nagar East,

Agrasen Marg, Bhilai,

C.G. 490020

Risk Factors – Investments in Mutual Funds are subject to Market Risks. Read all scheme related documents carefully before investing. Mutual Fund Schemes do not assure or guarantee any returns. Past performances of any Mutual Fund Scheme may or may not be sustained in future. There is no guarantee that the investment objective of any suggested scheme shall be achieved. All existing and prospective investors are advised to check and evaluate the Exit loads and other cost structure (TER) applicable at the time of making the investment before finalizing on any investment decision for Mutual Funds schemes. We deal in Regular Plans only for Mutual Fund Schemes and earn a Trailing Commission on client investments. Disclosure For Commission earnings is made to clients at the time of investments.

AMFI Registered Mutual Fund Distributor – ARN-99688 | Date of initial registration – 08-Jan-2015 | Current validity of ARN – 05-Jan-2027

Important Links | Disclaimer | Disclosure | Privacy Policy | SID/SAI/KIM | Code of Conduct | SEBI Circulars | AMFI Risk Factors