- +91 9406205550

-

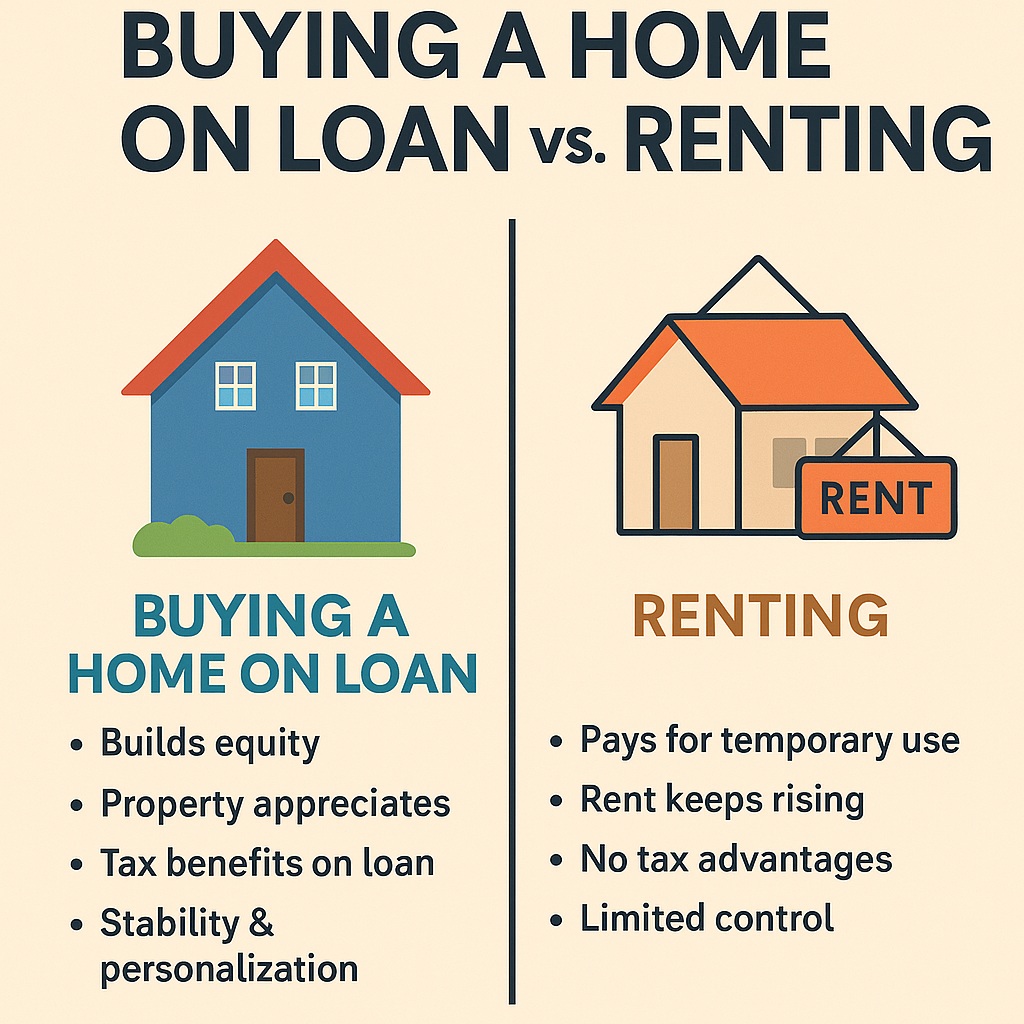

For many Indians — especially millennials and Gen Z — the question of buying a home vs. renting is one of the biggest financial dilemmas of adulthood.

On one side, renting feels flexible — no long-term commitments, no EMIs, and fewer responsibilities. On the other, buying a home — even with a loan — is a major milestone, a sign of financial maturity and stability.

But when we dive deeper into the numbers, mindset, and long-term impact, buying a home emerges as the smarter financial choice.

Let’s break it down.

🧾 1. Rent Is an Ongoing Expense, EMIs Build Ownership

When you rent a home, your monthly payment is pure expense. You’re paying to use someone else’s asset, and when you move out, you walk away with nothing to show for years of payments.

Contrast this with a home loan EMI. Yes, it might be higher than the rent — but every rupee goes towards building your own equity. Over time, your home becomes your asset, increasing in value even as your loan reduces.

💡 Let’s take an example:

In 15–20 years, you’d likely own the property outright, while a renter would still be paying monthly rent — now much higher due to inflation.

📈 2. Real Estate Is a Long-Term Asset That Grows in Value

Real estate is one of the few asset classes where you can live in your investment while it appreciates.

In most metro and tier-2 cities, property prices have historically shown a steady upward trend over 10–20 year periods.

And let’s not forget — even if property prices stay stable, the rent in the same locality will keep increasing, making ownership even more cost-effective over time.

💰 3. Home Loans Offer Attractive Tax Benefits

Buying a home with a loan gives you access to significant tax savings, which renters miss out on:

These benefits lower your taxable income, making the effective cost of home ownership much lower than it appears.

Renters can only claim HRA under certain conditions — and even that may not fully cover the rent paid.

🛠️ 4. Freedom, Control & Emotional Security

Renting often comes with limitations:

Owning your own home gives you:

For many Indians, a home is not just a financial investment — it’s a legacy, a symbol of success, and a safety net for the future.

🔁 5. Fixed EMIs vs. Rising Rents

One of the most overlooked advantages of buying is the predictability of EMIs.

Meanwhile, rent tends to increase 5–10% annually, depending on the city and demand.

Over 10 years, your rent could nearly double, while your EMI remains roughly the same — making ownership more affordable in real terms as your income also grows.

🤔 But What About Flexibility?

A common argument in favor of renting is flexibility — what if your job moves cities? What if you want to travel or relocate?

That’s a fair point. But buying doesn’t mean losing flexibility:

Moreover, if planned correctly, a home loan shouldn’t limit your lifestyle — it should complement your financial journey.

✅ Key Takeaways:

|

Factor |

Renting |

Buying |

|

Monthly Outflow |

Lower initially |

Higher (EMI) |

|

Long-term Benefit |

None |

Ownership & Wealth Creation |

|

Tax Benefits |

Limited (HRA) |

Multiple (80C, 24b, etc.) |

|

Flexibility |

High |

Moderate, but manageable |

|

Emotional Security |

Low |

High |

|

Cost Over 20 Years |

Continues to rise |

Ends after loan repayment |

📌 Final Thoughts: Pay Your Own Loan, Not Someone Else’s

Buying a home, especially with a loan, requires planning and discipline — but the rewards are tangible, both financially and emotionally.

While renting might seem cheaper today, it doesn’t help you build wealth. Every EMI, on the other hand, brings you closer to full ownership of a valuable asset.

So before you say, “I’ll rent for a few more years”, ask yourself:

Are you helping someone else build their wealth, or building your own?

🏡 A home is not just a roof over your head — it’s a foundation for your future.

Disclaimer:

This article is intended for general information and educational purposes only. Real estate and loan decisions should be made based on your personal financial situation and goals.

Mutual Fund investments are subject to market risks. Please read all scheme-related documents carefully before investing.

Some sections of this article were generated with the assistance of OpenAI’s ChatGPT to enhance structure and clarity.

Tags : buy vs rent, real estate India, home loan benefits, tax saving through home loan, financial planning, investment tips, housing market India,

Office Phone :

(+91) 9406205550

Bachat Plus

62/6 Nehru Nagar East,

Agrasen Marg, Bhilai,

C.G. 490020

Risk Factors – Investments in Mutual Funds are subject to Market Risks. Read all scheme related documents carefully before investing. Mutual Fund Schemes do not assure or guarantee any returns. Past performances of any Mutual Fund Scheme may or may not be sustained in future. There is no guarantee that the investment objective of any suggested scheme shall be achieved. All existing and prospective investors are advised to check and evaluate the Exit loads and other cost structure (TER) applicable at the time of making the investment before finalizing on any investment decision for Mutual Funds schemes. We deal in Regular Plans only for Mutual Fund Schemes and earn a Trailing Commission on client investments. Disclosure For Commission earnings is made to clients at the time of investments.

AMFI Registered Mutual Fund Distributor – ARN-99688 | Date of initial registration – 08-Jan-2015 | Current validity of ARN – 05-Jan-2027

Important Links | Disclaimer | Disclosure | Privacy Policy | SID/SAI/KIM | Code of Conduct | SEBI Circulars | AMFI Risk Factors