- +91 9406205550

-

When we invest, especially in equities and mutual funds, we often hear phrases like “this fund has delivered 12% annualised return over 5 years.”

At first glance, many investors assume this means their money grew steadily by 12% each year. But that’s not how equity markets work.

The truth is, investment returns are not linear. Equity and related instruments fluctuate based on market conditions, business cycles, investor sentiment, and global events. This means that the path to a 12% annualised return might involve big ups in some years, downs in others, and steady performance in between.

Understanding this reality is crucial for making informed investment decisions and for staying committed to your financial goals.

🔹 Linear Growth: The Misconception

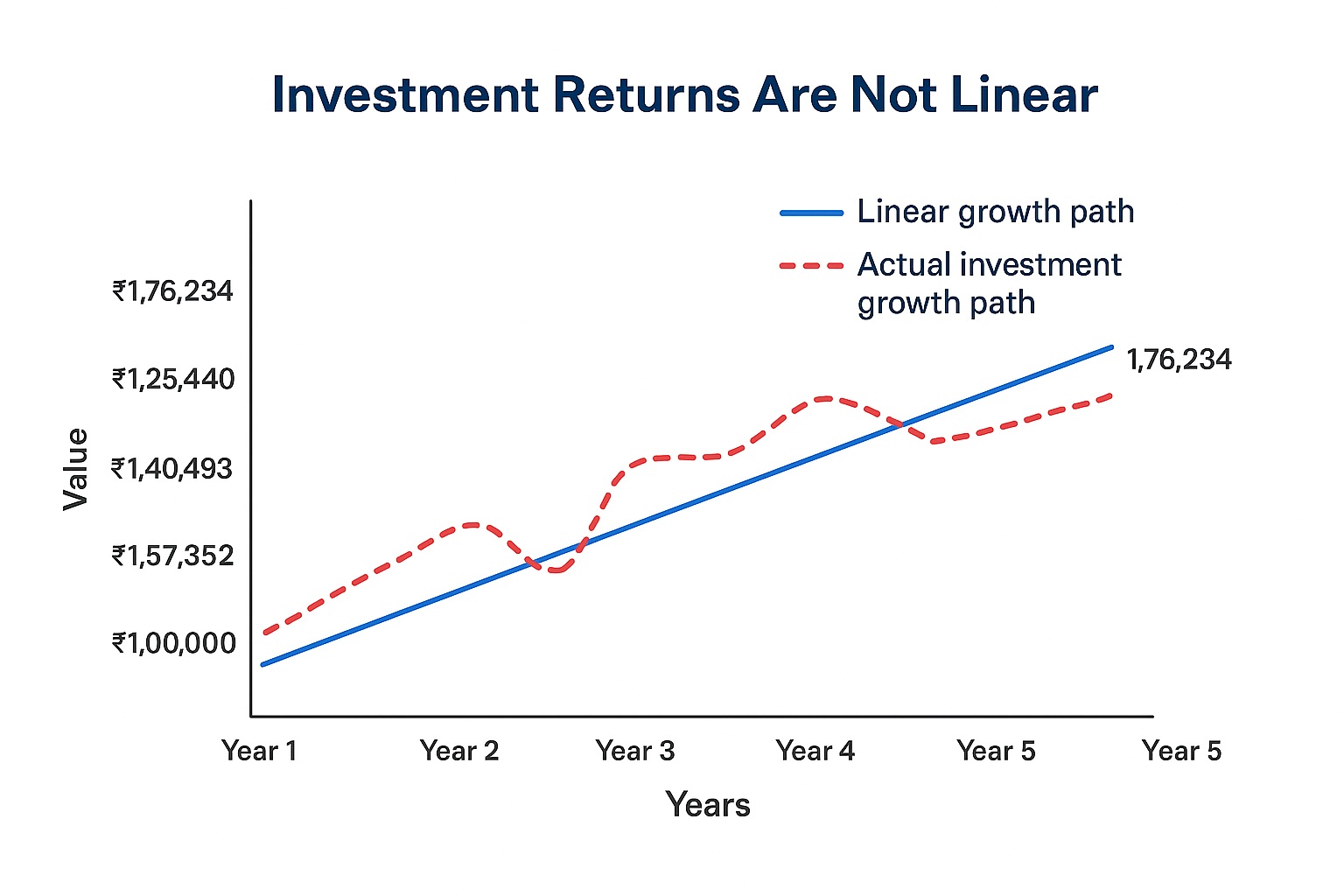

Let’s say you invest ₹1,00,000 expecting a 12% annualised return for 5 years. You might imagine a smooth, linear compounding journey:

This shows perfect compounding. It’s neat and predictable—but unfortunately, it’s not how equity investing works.

🔹 The Reality: Volatility Along the Way

In actual markets, your investment journey could look like this instead:

Notice that the final outcome is still in line with 12% annualised growth (~₹1,76,000 after 5 years)—but the path is far from linear. Some years bring sharp gains, others deliver declines, but over time the power of compounding brings the return closer to the expected average.

🔹 Why Understanding This Matters

🔹 Practical Tips for Investors

✅ The Takeaway

When you hear that an investment delivered 12% annualised return over 5 years, remember:

👉 It does not mean a consistent 12% every year.

👉 Some years could see sharp gains, while others may even show negative returns.

👉 What matters is the compounded outcome over the long term.

The real secret to wealth creation is not expecting smooth, linear growth but embracing volatility as part of the journey and staying disciplined with your investment plan.

⚠️ Disclaimer

Office Phone :

(+91) 9406205550

Bachat Plus

62/6 Nehru Nagar East,

Agrasen Marg, Bhilai,

C.G. 490020

Risk Factors – Investments in Mutual Funds are subject to Market Risks. Read all scheme related documents carefully before investing. Mutual Fund Schemes do not assure or guarantee any returns. Past performances of any Mutual Fund Scheme may or may not be sustained in future. There is no guarantee that the investment objective of any suggested scheme shall be achieved. All existing and prospective investors are advised to check and evaluate the Exit loads and other cost structure (TER) applicable at the time of making the investment before finalizing on any investment decision for Mutual Funds schemes. We deal in Regular Plans only for Mutual Fund Schemes and earn a Trailing Commission on client investments. Disclosure For Commission earnings is made to clients at the time of investments.

AMFI Registered Mutual Fund Distributor – ARN-99688 | Date of initial registration – 08-Jan-2015 | Current validity of ARN – 05-Jan-2027

Important Links | Disclaimer | Disclosure | Privacy Policy | SID/SAI/KIM | Code of Conduct | SEBI Circulars | AMFI Risk Factors